Featured

Scaling Humanitarian Impact Bonds: What Really Matters

Humanitarian Impact Bonds (HIBs) hold immense potential to mobilise private or philanthropic capital upfront for those who need it most, yet the question remains: how can they scale and replicate instead of remaining as bespoke, one-off pilots?

19th Feb, 2026

read more

Publications

Scaling Humanitarian Impact Bonds: What Really Matters

Humanitarian Impact Bonds (HIBs) hold immense potential to mobilise private or philanthropic capital upfront for those who need it most, yet the question remains: how can they scale and replicate instead of remaining as bespoke, one-off pilots?

19th Feb, 2026

2025 Year In Review: Newsletter

This edition of our newsletter looks forward to an expanded Humanitarian Finance Summit in February 2026, co-hosted by the Forum and AidEx at the QEII this February, while reviewing our 2025 highlights.

6th Jan, 2026

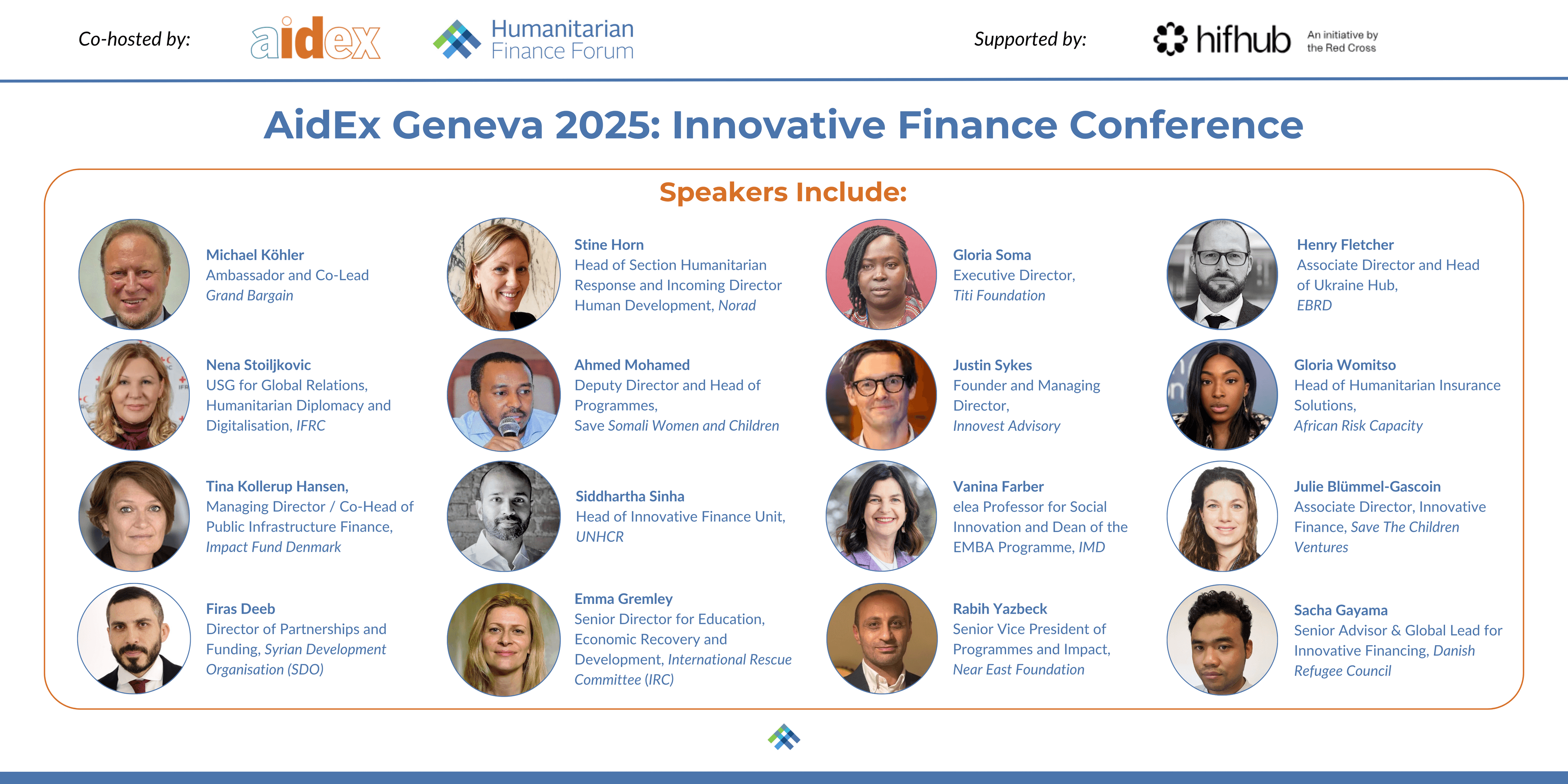

Executive Summary: AidEx Geneva 2025 - Humanitarian Innovative Finance Conference

On 22-23 October, AidEx and the Humanitarian Finance Forum (HFF), with support from the HIFHUB, convened the Innovative Finance Conference at AidEx Geneva 2025. The following summary highlights the key themes, discussions, and insights that emerged from the sessions, as well as the practical pathways identified for translating innovation into action.

5th Nov, 2025

Case Studies Recap: AidEx Geneva 2025 - Humanitarian Innovative Finance Conference

The Humanitarian Finance Forum, AidEx, and HIFHub (a Red Cross initiative) convened the AidEx Innovative Finance Conference - Case Studies Room, which spotlighted practical, field-tested innovative financial tools for humanitarian challenges. This note, developed with support from the IMD Center for Social Innovation, captures key insights to sustain the conversation and serve as a model to others.

4th Nov, 2025

The Role of Governments: In Unlocking Private Capital

With traditional humanitarian aid donor still pulling back, private capital is often cited as the answer. Yet, in practice, very little flows into fragile settings. The barriers are well known but one critical aspect remains underexamined: How success is measured.

21st Oct, 2025

2025 Q3: Newsletter

In this quarter’s update, we invite you to attend AidEx 2025; highlight innovative financial models that are tangibly supporting humanitarian goals; and welcome you to submit case studies for the 2026 Humanitarian Finance Summit.

1st Oct, 2025

Event Summary: Roundtable

Together with UK Foreign, Commonwealth & Development Office (FCDO), Instiglio, and DanChurchAid, we convened a private roundtable to examine the design and objectives of the Syria Humanitarian Mine Action (HMA) and Livelihood Development Impact Bond (DIB).

16th Jul, 2025

2025 Q2: Newsletter

In this quarter’s update, we spotlight the liquidity crisis threatening humanitarian response and actions forward.

2nd Jul, 2025

Leveraging insurance for anticipatory action: insights and emerging lessons

The Anticipation Hub and the Munich Climate Insurance Initiative recently published a working paper that reveals how insurance, traditionally a post-disaster tool, is being adapted to fund anticipatory action.

23rd Jun, 2025

Global Humanitarian Assistance Report 2025

The Global Humanitarian Assistance (GHA) report is the world-leading annual assessment of the state of international humanitarian financing, published by the ALNAP Network.

16th Jun, 2025

Webinar Summary: Developing Solutions to Address the Humanitarian Liquidity Crisis - A Shared Responsibility

Following our webinar last week on ‘A Shared Responsibility: Developing Solutions to Address the Humanitarian Liquidity Crisis’, here are key takeaways from the discussion with Elise Baudot (ICVA Network), Yolaina Vargas-Pritchard (Start Network), Simon Meldrum (HFF), alongside remarks from Alice Soukupova (DG ECHO)

24th Apr, 2025

ICVA Humanitarian Innovative Financing: 'Grab and Go' Pocket Guide

A pocket guide on "Humanitarian Innovative Financing" from the International Council of Voluntary Agencies (ICVA). It defines humanitarian innovative financing as a range of models and approaches that use humanitarian grants to attract partnerships, capacity, and capital from the development, local, and private sectors.

10th Apr, 2025

Share your expertise!Got a groundbreaking report, insightful publication, or newsworthy story relevant to our community? We want to hear from you! Share your work for potential hosting on our platform and/or a dedicated Spotlight event. Contact: [email protected]